- Ecom CFO Notebook

- Posts

- Ecom CFO Notebook - the vendor review your partners hope for

Ecom CFO Notebook - the vendor review your partners hope for

Ecom CFO Notebook is a (mostly) strategic finance publication for $10M+ ecommerce operators.

What I write comes from the patterns, problems, and decisions from our client work at Ecom CFO - providing brands outsourced CFO, accounting, and financial operations.

I write because I enjoy it. And because it brings in great clients.

My inbox is open - respond to this email or schedule a call if you want to be one of them.

No one in my position is supposed to say you should be reviewing us. Every year.

Pulling our fees, reviewing our scope, asking whether the value still makes sense. Most of your vendors are praying you never do this. I'm going to show you exactly how.

Because last week I got an email from Marvin.

Subject: "Need to discuss our partnership."

In our business, that usually means one thing: they're leaving.

But Marvin wasn't leaving.

He was doing something I wish more founders did (or at least share with me).

A pragmatic, intentional review of vendors. He'd pulled his vendor expenses for the year, vetted three other firms, and built a spreadsheet comparing scope, pricing, and speed.

Then he scheduled a call with me and our team to tell us what we’re doing wrong have a discussion about the best path forward.

I’m not advocating for every client to shop us.

But as a finance guy, I can’t not recommend reviewing vendor relationships and contracts - not just the suppliers you buy products from.

This is NOT JUST ABOUT price.

It’s about value. And in our remote world where no one want to talk to anyone, it’s a small investment in time to reap big rewards throughout the year.

DTC founders spend insane energy on customer retention - Klaviyo flows, win back emails, feedback loops, loyalty programs - as they should. But too often I see founders neglect the agencies and service providers who support them in winning and retaining those customers.

If you only had 30 minutes, here here's how to execute an intentional, honest vendor review that adds margin to your bottom line.

3 Step Process For Reviewing Vendors

Step 1: Figure out which vendors are worth a review

You probably know your top vendors, but if not, a quick way to figure it out is to open QuickBooks or Netsuite and pull your expenses by vendor for the last 12 months. Then sort in descending order of cost.

You're looking for the top 3-5 by dollar spend AND strategic importance. Don't waste time on anything < $3K/month.

Focus on marketing agencies, customer service, consultants, legal, and other professional services firms - relationships worth cultivating.

Step 2: Ask for an annual review meeting

Once you have your top vendors, reach out to them to set up an annual review meeting (if they haven’t already).

I’m including an email template below, but you are asking for the following:

Everything they worked on for this past year (including one-offs)

What's working vs. what's not worth doing anymore from their perspective

Opportunities for tasks to be cut or replaced to make room for better work

What is missing that they think is needed

Notice I’m not suggesting that the founder do any of the prep.

You’ve forgotten or haven’t paid enough attention anyway. We professional service firms generally keep better notes than you.

Below is a sample email you can use as a starting point.

Step 3: Have the conversation

Use this time to address any key issues but also work on maximizing the value of the relationship you're already paying for.

Here are a few questions in addition to the ones from the email you can use to direct the conversation:

1. Can we cut anything we're currently doing? A lot of deliverables exist purely because "we've always done it.". Cutting low-value work creates budget and bandwidth for higher-leverage projects.

2. Where can we go faster? Speed is a legitimate differentiator. Your marketing agency might be taking two weeks to execute campaigns when they could do it in three days. You don't know until you ask.

3. Are you open to consolidating more work under one roof? Consolidating vendors means fewer relationships to manage and better context for the work. If you like a vendor, try to do more with them.

Make sure your vendor brings the owner AND the person accountable for executing the work. In our call with Marvin, I brought our COO and the accounting manager who owns Marvin's account day-to-day.

When Marvin raised issues about slow closes and inconsistent bookkeeping, the accounting manager heard it directly so there was no telephone game between team members.

From the vendor side: The client who speaks up gets the fix. The client who stays quiet just gets more frustrated. We assume everything is fine unless you tell us otherwise.

Final Thoughts

Hopefully that conversation leads to more value from the service provider.

But if you are unhappy with what you learn from your current vendor, that’s the time to get comparison quotes from 2-3 other firms.

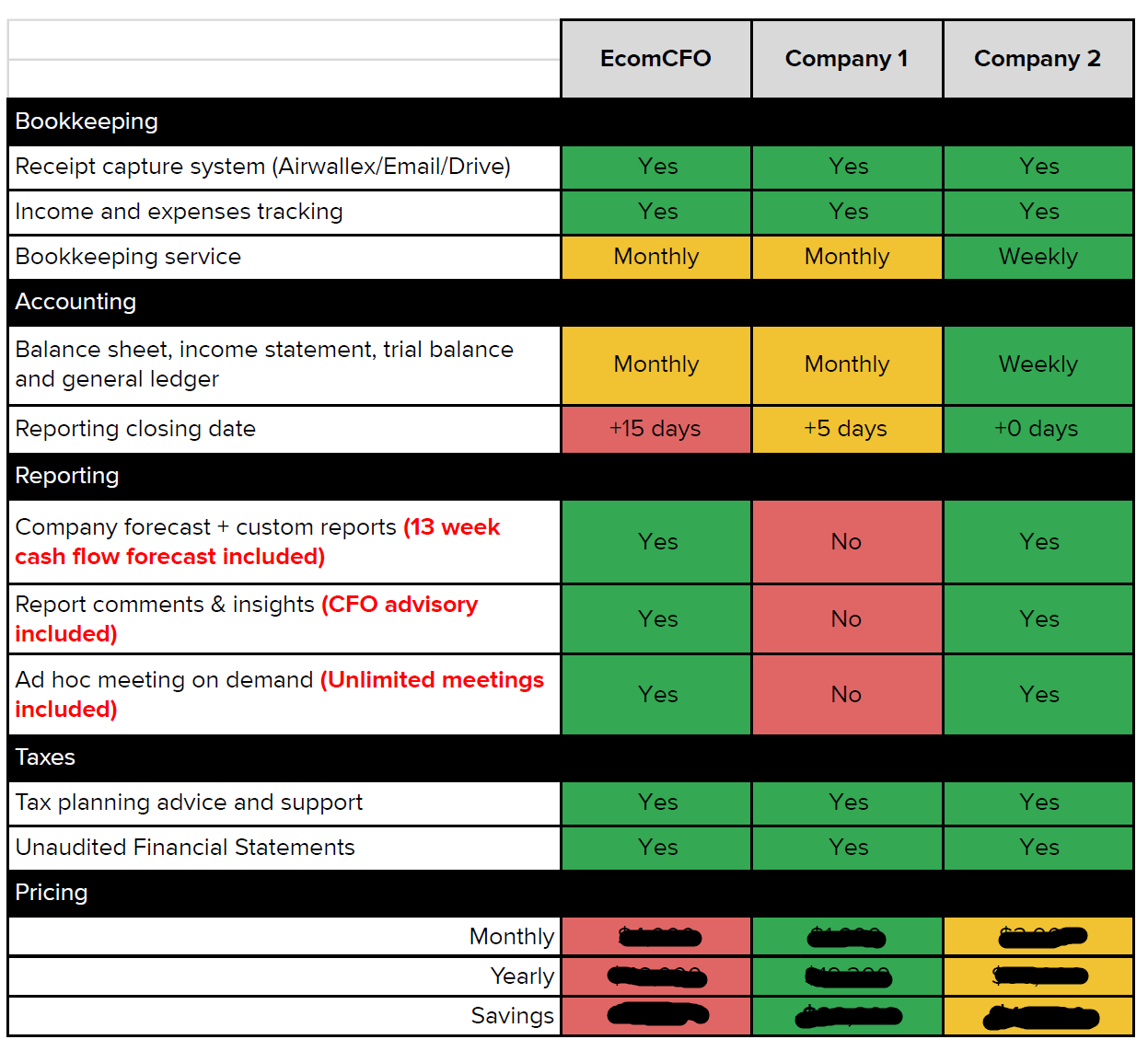

Below is the spreadsheet Marvin used to compare us. I turned it into a template you can steal.

Focus on getting the same scope and seniority so you can compare apples to apples.

Sometimes we work with people just because we like them. Only you can determine the balance of likability and competency. Marvin even said it on our call: "I really like you and the team, but if I can get the exact same support for 20% less, I'm going to do it."

I completely respect that. Business is business. Get all the facts then make the decision that is best for your business

The start of the year is usually a good time for this. But honestly, it doesn't matter when you do it.

What matters is that you actually do it.

Your best vendors want this feedback and want to know where they're falling short so they get the chance to fix it. It’s a win win for both parties.

Structuring these reviews can save you tens of thousands of dollars. Or unlock way more value from relationships you already have.

— Sam

Looking for more? Some of our most popular posts:

2025 Q3 Benchmark Report: Key insights from financials across 30+ companies – including revenue growth, margins, ad spend, and more.

The issue with KPIs: Everyone has tons of data, but doesn’t know what to do with it. This is my take on managing the right metrics.

Responsibility Map: I walk through how to define who owns, participates in, and supervises every key finance & accounting deliverable